Fighting for All of US!

The Walworth County Democratic party celebrates the inherent diversity across our county while supporting the economic and social wellbeing of all county residents. Our mission is to engage voters to elect and support candidates who share our democratic values. We believe in fairness, honesty, freedom, opportunity, security and tolerance, and that human and civil rights are basic freedoms, which belong to everyone.

Join us in making a difference for our county and state. Attend our General Meetings where we have informative guests such as James Santelle who served as United States attorney for the Eastern District of Wisconsin and Interim United States Attorney. Click here to view his presentation.

Remember, your voice is your power! Together, we can create positive change and shape the future we believe in.

-

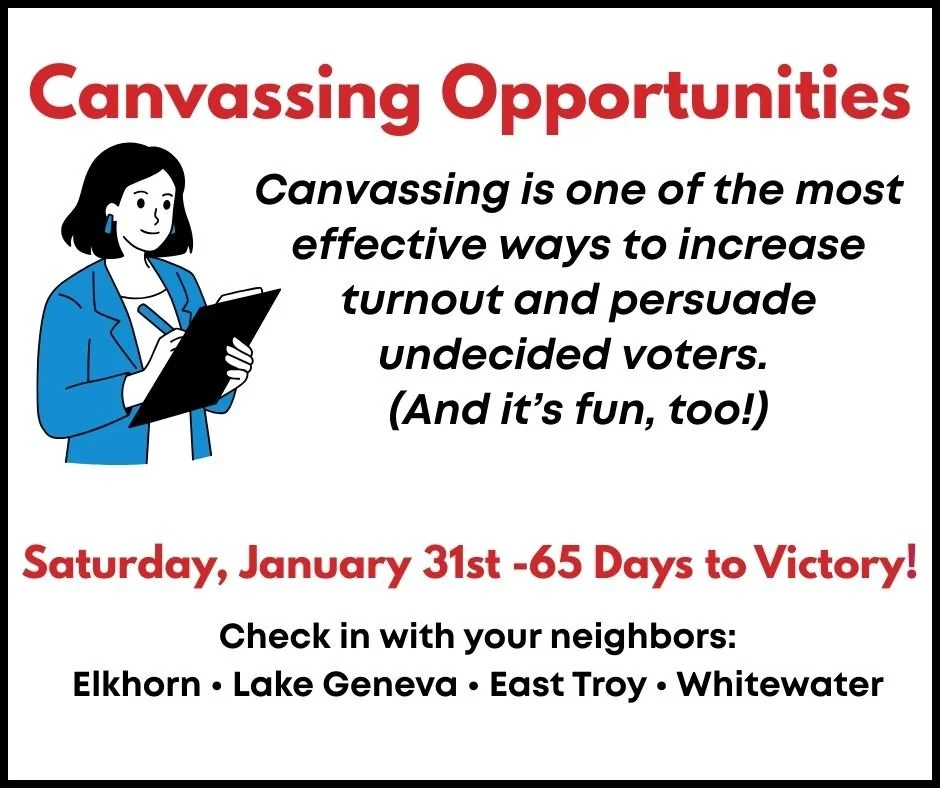

Canvassing Begins!

January 31st is our first canvass day of the year. Let's knock doors and encourage our neighbors to vote in the upcoming elections. We'll have four staging locations. Please sign up below for a time and neighborhood:

+East Troy:

https://www.mobilize.us/wisdems/event/882098/

+ Elkhorn:

https://www.mobilize.us/wisdems/event/882105/

+ Lake Geneva: https://www.mobilize.us/wisdems/event/882101/

+ Whitewater:

https://www.mobilize.us/wisdems/event/882106/

Don't want to canvass but would like to be a driver, phone banker, work a staging location, or provide hospitality for any of our weekends of action? Please sign up here.

-

UWW College Dems 75th Anniversary Event

UW-Whitewater College Democrats are hosting a 75th anniversary event on Friday, February 13th from 5-7pm on the UW-Whitewater campus. It will be a celebration of the long history of progressive organizing on UW-Whitewater's campus.

This event will be attended by current College Dems members, current students, former UW-Whitewater alumni, and local community members. Walworth Co. Dems is helping to co-host this event with UW-Whitewater College Dems.

Our confirmed speakers are Wisdems Chair, Devin Remiker, State Rep. Brienne Brown, State Sen. Mark Spritzer, Mayor of Delavan Ryan Schroeder, and VP of Whitewater School Board Miguel Aranda.

There will be light refreshments.

Get your ticket now by clicking here. -

Use Your Voice

Protest with us.

Join a Neighborhood Team.

Attend our meetings.

Subscribe to weekly newsletter (eBlast).

Follow and share our social media posts:

Read and write for Dems Dispatch Substack. To submit your writing, click here.

See more ways to Participate.